Base Salary

Base salary is intended to provide a fixed, baseline level of compensation that is not contingent upon Align’sour performance. Consistent with our pay-for-performance philosophy, base salaries generally represent a modest proportion of the total compensation opportunity for our executive officers.senior management. In January 2015,2020, the Compensation Committee reviewed the base salaries of our NEOs, comparing these salaries to the base salary levels at theof companies in our peer group, as well as considering the roles and responsibilities and potential performance of the NEOs and their positioning for other elements of their compensation. After this review, the Compensation Committee made the adjustments to base salary set forth in the table below. Mr. Relic’s 15% increase

| | | | | | | | | | | | | | | | | | | | |

| Name | | 2019 Base Salary | | 2020 Base Salary | | Percentage Increase |

| Joseph M. Hogan | | $ | 1,130,000 | | | $ | 1,175,000 | | | 4.0% |

| John F. Morici | | $ | 500,000 | | | $ | 540,000 | | | 8.0% |

| Simon Beard | | $ | 440,000 | | | $ | 520,000 | | | 18.2% |

| | | | | | |

Julie Tay(1) | | $ | 495,000 | | | $ | 520,000 | | | 5.1% |

| Raj Pudipeddi | | $ | 465,000 | | | $ | 490,000 | | | 5.4% |

(1) Ms. Tay's annual base salary is payable in Singapore dollars. Values in the table are converted into U.S. dollars based on the exchange rate in effect as of each pay date. As of December 31, 2020, as a result of fluctuations in exchange rates, Ms. Tay's actual salary in 2020 was made in connection with his strong individual performance as well as closing a significant gap between his salary and the salary of other members of the executive management team and moving it to more closely approximate the market 50th percentile.$533,157.

|

| | | | | | |

| Name | | 2014 Base Salary | | 2015 Base Salary | | Percentage Increase over 2014 |

| Joseph M. Hogan | | N/A | | $950,000 | | N/A |

| Thomas M. Prescott | | $650,000 | | $675,000 | | 3.8% |

| David L. White | | $407,000 | | $424,000 | | 4.2% |

| Raphael S. Pascaud | | $350,000 | | $369,000 | | 5.4% |

| Zelko Relic | | $310,000 | | $358,000 | | 15% |

| Roger E. George | | $354,000 | | $370,000 | | 4.5% |

Mr. Hogan’sThe base salary of $950,000 was basedeach NEO reflects our significant growth and the role of each NEO in that achievement. For Mr. Beard, his increase is primarily a reflection of his increased responsibilities as Senior Vice President and Managing Director, Americas which required him to relocate to the United States in September 2019 on a reviewthree year employment assignment away from his family. Ms. Tay's increase includes the impact of peerexchange rates between her local currency, the Singapore dollar, and our reporting currency, the U.S. dollar. In the case of Mr. Hogan, his base salary reflects his position as our most senior executive officer, his vigorous leadership since joining Align as our CEO, compensation, as well as pay packages for recently hired CEOs as discussed above under “CEO Transition”.our strong performance during his tenure, and recognition of the salary that someone with his proven ability and track record could command in the competitive market.

Annual Cash Incentive Compensation

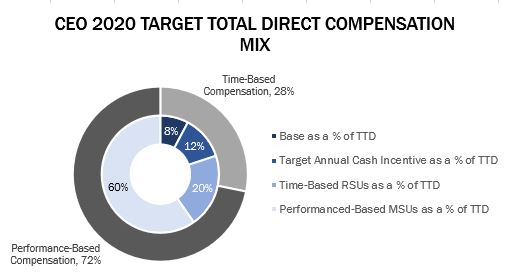

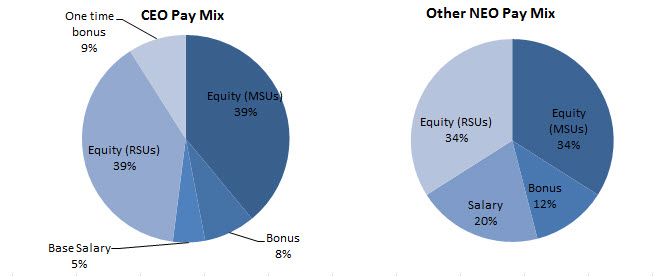

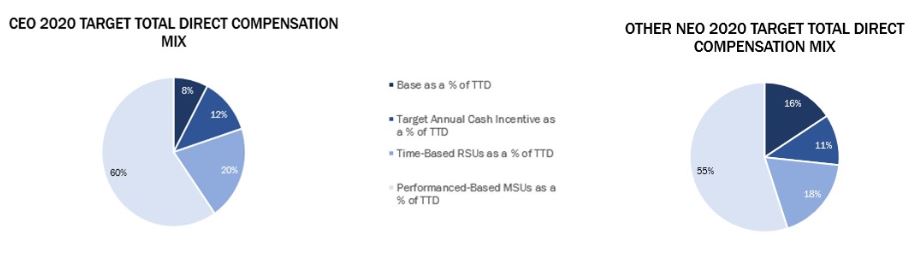

Annual Cash Incentive Plan. Align usesWe use a cash incentive compensation plan to reward senior management, including all of our NEOs, for achieving and surpassing pre-established financial goals. In December 2019, the Compensation Committee conducted its annual review of our Annual Cash Incentive Award plan ("Bonus Plan"). Based on its review, the Compensation Committee determined that the pool of funds available to pay out awards to our senior management for performance in 2020 would continue to be based on the extent to which we met or exceeded predetermined goals under selected financial metrics. Consistent with prior years, the Compensation Committee selected two financial metrics, weighted as identified below, for purposes of funding the overall Bonus Plan pool for 2020:

•Revenue - 60%

•Operating Income - 40%

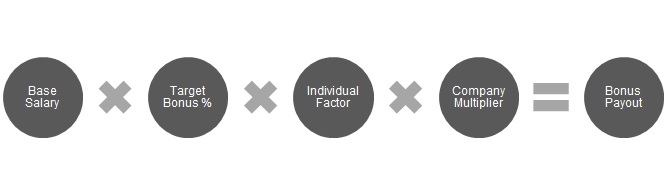

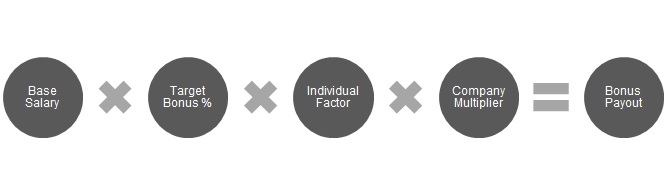

Considered in the aggregate, the Compensation Committee believes these metrics are strong indicators of our overall performance and our ability to a lesser extentcreate stockholder value. These measures balance propelling growth while encouraging efficiency and are aligned with our strategic priorities of international expansion, GP adoption, patient demand and conversion and orthodontist utilization. In determining actual bonuses to be awarded to each member of senior management, bonus amounts are adjusted, either up or down, based on her or his overall performance and contribution to the achievement of key strategic measures, which are expected to increase stockholder value. All of our NEOs participated in the executive bonus plan. Bonus determinations for fiscal 2015 performance were calculated using the following formula:goals.

The Individual and Company Multipliers are each derived based on performance and are equally weighted.

Target Bonus Percentage.The target award opportunity is the amount of cash incentive compensation that our NEOseach member of senior management could expect to earn if Align’swe achieved our financial and strategic performance goals for the year are achieved. Each executive officer is assigned a target award opportunity of 60% of his or her base salary, except for Mr. Hogan who is assigned a target award opportunity of 150% of his base salary. Prior to his retirement, Mr. Prescott’s target award opportunity was 100% of his base salary.year. The incentive targets for members of the NEOssenior management were set by the Compensation Committee based on the scope and significance of their roles as theour leaders, of Align, with theour CEO receiving the highest target due to his greater responsibilities. The target awards as a percent of base salary for each member of senior management (other than our CEO) was 70% of base salary in 2020, consistent with 2019. Mr. Hogan's 2020 target award opportunity also remained unchanged at 150% of his base salary. In addition, in order to appropriately encourage and reward a range of acceptable performance and contributions in fiscal year 2020, our awards arewere structured so that the actual payout under an executive officer’s award canto a member of senior management could be as low as 0% of target or up to a maximum award of 240% of target.

As a result of the significant impact of the COVID-19 pandemic on our business in the first half of 2020, our Compensation Committee performed a mid-year review and reassessment of our 2020 Bonus Plan performance goals. Following this review and reassessment, the Compensation Committee determined not to redesign the Bonus Plan, but instead to simply reset the original annual performance targets under both of the financial metrics to focus solely on second half of 2020 recovery efforts based on revised, mid-year internal estimates. In so doing, the Compensation Committee also reduced by half the potential target payout amounts, from 100% to 50%, and reduced the maximum amount payable under the Bonus Plan to members of senior management from 240% to 120% of their bonus award opportunity. Had the Compensation Committee not made this mid-year revision, there would have been no payments to senior management under the full-year Bonus Plan. Please see the further discussion below under "Impact of the COVID-19 Pandemic on the 2020 Annual Cash Incentive Plan" for a more detailed discussion of the mid-year adjustments to our 2020 Bonus Plan performance goals.

Individual Multiplier.Factor. The Individual MultiplierFactor reflects each executive’s individual performance and is determined at the Compensation Committee’s discretion based on the recommendationCommittee's assessment of the CEO. Thisspecific performance appraisal process is largely subjective, with much discretion exercised by our CEO andof each member of senior management in light of the Committee.achievement of her or his individual goals. There is no specific weight given to any one individual goal or performance criterion. The Compensation Committee considers each executive officer’s performance in lightthe views of that individual’s achievement of his or her individual goals. The assessment is based on our CEO and Compensation Committee’s determinations regarding how well the executiveeach performed hisher or herhis job, and such assessment is qualitative, not quantitative, in nature. The CEO does not provide input to the Compensation Committee onregarding his own performance. Individual performance that meets expectations yields a 100% multiplier, with a maximum rating of 200%.multiplier.

Company Multiplier.The Company Multiplier is the same for all executive officers. The Company Multipliermembers of senior management. It is determined based on pre-established goals under selected financial targets. The Compensation Committee reviewed the structure of the Bonus Plan and key company strategic objectives. While managementselected two financial metrics that focused on (1) growth and (2) profitability for purposes of funding the overall pool. Management typically recommends the performance targets for bonus pool funding the Bonus Pool based on our Annual Operating Plan,annual operating plan as well as reference to historical performance and revenue and operating profit growth rates at select comparable medical device companies, but the targets are ultimately approved by the Compensation Committee and reviewed by the BoardBoard. For 2020, the Compensation Committee originally established 100% Bonus Pool funding based on revenue of Directors. At$2,862.0 million and operating income of $636.0 million or 22.2% of revenues. These targets were later reset (and the beginningbonus opportunity reduced by 50%) to focus solely on performance objectives for the second half of 2015,2020 of $1,451.0 million and $298.0 million for revenue and operating income, respectively, or 20.5% of revenues. Please see the Committee reviewed the structurediscussion below under "Impact of the executive bonus plan and determined that it was appropriateCOVID-19 Pandemic on the 2020 Annual Cash Incentive Plan" for a further discussion of the mid-year adjustments to continue to focus on (1) growth, (2) profitability, and (3) the achievement of critical strategic priorities.our 2020 Bonus Plan performance goals.

The following table below shows the performance metrics used in 20152020 and our level of performance with respect to these metrics:metrics.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Measure/Weight/ Calculates | | Why do we use this measure? | | Original Target (2020) (in millions) | | Achievement (2020) (in millions) (1) | | Revised Target (2H 2020) (in millions) | | Achievement (2H 2020) (in millions) (1) | | Level of Achievement vs Revised Target | | (2H 2020) Impact on

Company

Multiplier |

| | | | | | | | | | | | | | |

Revenues (1) (2) (3) (60%) | | Improvement in this measure aligns with our overall growth strategy | | $2,862 | | $2,472 | | $1,343 | | $1,564 | | 116.4% | | 304% |

Operating income (1) (2) (3) (40%) | | Directly links incentive payments to profitability and provides incentives to employees (including management) to share in our profitability. Because profitability encompasses both revenue and expense management, the Compensation Committee believes this measure encourages a balanced, holistic approach to managing our business. The Compensation Committee considers operating profit before taxes because management cannot predict or directly affect our taxes or our tax rate. | | $636 | | $387 | | $262 | | $387 | | 147.7% | | 447% |

| COMPANY MULTIPLIER: | | | | | | | | | | | | 120% |

|

| | | | | | | | | | | | | | |

Measure/Weight/ Calculated | | Why do we use this measure? | | Target (in millions) | | Achievement (in millions) | | Level of Achievement of Target | | Impact on Company Multiplier |

| | | | | | | | | | | | | |

Revenue (1)(2) (40%) | | Improvement in this measure aligns with our overall growth strategy. | | $881.6 | | $880.4 | | 99.9% | | | 39.8% | |

| | | | | | | | | | | | | |

Adjusted Non-GAAP Operating income (1) (2) (30%) | | Directly links incentive payments to Company profitability and we want our employees (including our executives) to share in our profitability. Because profitability encompasses both revenue and expense management, the Compensation Committee believes this measure encourages a balanced, holistic approach by our executives to manage our business. The Compensation Committee considers operating profit before taxes because our executives cannot predict or directly affect our taxes or our tax rate. | | $264.6 | | $268.2 | | 101.4% | | | 33.1% | |

Roadmap Elements (30%)

Delivering key elements of Company roadmap projects or initiatives, including meeting delivery dates and feature set requirements. (4) | | Critical to our achievement of our multi-year strategic corporate priorities, specifically, increased adoption and frequency of use by our customers, the orthodontist and general practitioner dentist and increased consumer demand. (3) | | 100% | | | 92.4% | | | 92.4% | | | 27.7% | |

| COMPANY MULTIPLIER: | | | | | | | | 100.6% | |

| |

(1)(1)During the second half of 2020, revenue and operating income achievement were adjusted downwards by $5.0 million and $4.0 million, respectively. The adjustments were due to a 0.8% benefit in foreign exchange compared to the assumptions made in our revised second half operating plan. On a full year basis there would not have been a similar adjustment as the impact from foreign exchange was below the minimum threshold required for adjustment. The Compensation Committee had previously approved adjustments (upwards or downwards) to our full-year 2020 Bonus Plan results in the event the impact of foreign exchange was above 4.7 percentage points. No other adjustments were made to either the target or the level of achievement.

| The threshold performance and the level of performance at which the funding for that particular financial performance measure will be capped as follows: |

(2)The target performance and the level of performance at which the funding for that particular financial performance measure will be capped as follows:

•A rating of zero if achievement is below 90%. of target. Company performance below target automatically reduces only the payout related to that goal, not the other goals,goal, as we want executivessenior management to have the same incentive to achieve other financial goals as well as their individual performance goals even if our performance tracks below the target during the course of the year;

•A rating ranging from 60%90% to 100% if achievement meets or exceeds the minimum performance level but does not achieve the target performance level; and

•A rating of 101% to 200%and above if achievement meets or exceeds the target performance level. Each individual financial metric is uncapped; however, once the Company Multiplier reaches 240% in the aggregate, which was reduced to 120% based on the Compensation Committee's mid-year review and reassessment of the performance goals as a result of the impact of the COVID-19 pandemic on our business, the adjusted the Bonus Pool is fully funded. Therefore, in the aggregate, as originally approved the Bonus Pool for senior management could not exceed 240% funding, which was later reduced to 120%. Please see the discussion below under "Impact of the COVID-19 Pandemic on the 2020 Annual Cash Incentive Plan" for a further discussion of the mid-year adjustments to our 2020 Bonus Plan performance goals.

| |

(2)(3)The Compensation Committee has the discretion to exclude the following items from Revenues and Operating Income: (a)significant and/or extraordinary items that are not indicative of our core operating performance that are separately stated on our financial statements; (b)items identified as non-GAAP in our quarterly earnings announcements; and (c)other discrete items as necessary that may result in unintended gain or loss under the bonus plan.

| Adjusted Non-GAAP Operating Income was adjusted to exclude stock based compensation expense. The Compensation Committee also has the discretion to exclude the following items from Revenue and Operating Income: |

| |

(a) | significant and/or extraordinary items that are not indicative of our core operating performance that are separately stated on our financial statements; |

| |

(b) | items identified as non-GAAP in the Company’s quarterly earnings announcements; and |

| |

(c) | other discrete items as necessary that may result in unintended gain or loss under the bonus plan. |

The Compensation Committee believes that the items listed in (a) through (c) above are not indicative of our core operating performance. Appendix AThe only adjustment made to this proxy statement includes a reconciliation of adjusted Non-GAAP operating income and Revenue achievement to the most comparable GAAP measures.our 2020 bonus plan results is described in note (1) above.

| |

| Management believes, and the Committee concurs, that the specific strategic initiatives and performance goals established for each of these strategic priorities represent confidential business information, the disclosure of which would result in meaningful competitive harm. |

| |

(4)

| For each strategic performance measure, a rating ranging from 0% to 150% based on relative achievement of the particular measure. |

The Compensation Committee believes that the financial metrics performance objectives originally established for the financial and key strategic objectives representrepresented meaningful improvements over 2019 annual performance for the organization and therefore, are reasonably difficult to attain which isthat the revised objectives would incentivize a swift and significant rebound after the unanticipated COVID-19-related material declines in line with our pay-for-performance philosophy.the first half of 2020. Finally, the Compensation Committee reserves the right to apply judgment in the final determination of cash incentive awards and can adjust actual results (up or down) to reflect the impact of certain extraordinary items or events to more accurately reflect the overall performance of the management team.

In addition, the Board of Directors retains authority to pay additional discretionary bonuses outside the executive bonus planBonus Plan if warranted by performance not measured under the plan. In 2015,2020, neither the Board nor the Compensation Committee did not authorizeauthorized any such discretionary bonus payments outsideto our NEOs.

Impact of the executive bonus planCOVID-19 Pandemic on the 2020 Annual Cash Incentive Plan. The COVID-19 pandemic significantly affected our business and the business of our customers throughout fiscal year 2020. Beginning in the first quarter and continuing into the second quarter, we experienced a rapid and unanticipated downturn in sales initially in Asia, particularly in China. As the virus spread beyond China, into Europe and thereafter the Americas in early March, sales quickly decelerated as the practices of many of our customers were severely curtailed or completely closed. By mid-March 2020, most governments in EMEA and North America had begun to our NEOs, except with respect to Mr. Hogan who received a one-time cash bonus payment in connection with commencing employmentclose or already had closed non-essential businesses and initiated stay at home orders, with the Company.vast majority of dental practices completely shut down or severely restricting patient visits. As a result, our sales fell sharply and rapidly.

As the COVID-19 pandemic response evolved during the second quarter of 2020, dental practices began to reopen such that by the end of the second quarter practices across every region had largely reopened and were beginning to again see patients, although at varying capacities and the vast majority below pre-pandemic levels of operations. Despite the re-openings, our key financial metrics for the first half of 2020 materially trailed our results for the first half of 2019. For the six months ended June 30, 2020, we recorded net revenues of $903.3 million, a decrease of 21.4%compared to the same period in 2019.

As reported in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2020, we anticipated that, at least in the short term, our business could continue to be particularly susceptible to the impact of the COVID-19 pandemic. We believed that all or a material portion of our products could be viewed as discretionary purchases and therefore more susceptible to any global or regional recession resulting from efforts to prevent or delay the spread of the virus. Moreover, we expected that efforts to slow or prevent a recurrence of the spread of the virus were likely to continue causing disruptions and uncertainties in the markets and require significant costs and efforts on the part of our customers to ensure the health and safety of their patients resulting in curtailed operations by our customers and decreased patient visits for an indeterminate period of time. The uncertain scope and duration of the pandemic, and the uncertain timing of the global recovery and economic normalization, was so unprecedented and made internal forecasting so difficult that we discontinued providing quarterly financial guidance.

Due to the impact caused by the COVID-19 pandemic on our business performance and the uncertainties expected to continue, including lower than expected sales of our Invisalign clear aligners and iTero intraoral scanners, our Compensation Committee performed a mid-year review and reassessment of our 2020 Bonus Plan performance goals to determine whether the original metrics and performance goals continued to appropriately incentivize employees in light of revised 2020 financial performance estimates. The result of this review and reassessment being the Compensation Committee's decision to reset our

performance targets to the second half of 2020. In addition,setting the revised targets, the Compensation Committee utilized the same methodologies it used when setting the original 2020 annual performance goals other than restricting the performance targets to the six month period of the second half of 2020. The Compensation Committee also reduced the potential target payout amounts by 50% and similarly reduced the maximum amount payable to members of senior management by half, from 240% to 120%.

In revising the financial metric targets and potential bonus awards, the Compensation Committee determined that the revised goals were reasonable and justifiable based on several factors, including the following:

•although the performance targets were revised for employees and senior management, the revised targets for senior management were higher than those of other employees and therefore required higher achievements for senior management;

•rebounding from the material declines in connectionthe first half of 2020 to achieve strong financial performance amidst the significant uncertainties in the broader macroeconomic and societal environments caused by the COVID-19 pandemic should be appropriately encouraged;

•the changes to the performance targets were due to global factors outside the control of senior management and were implemented to motivate and incentivize them to quickly recover from an unprecedented and evolving global health crisis; and

•the revised goals were set at levels that, if met, would likely increase shareholder value and the Company's valuation.

The Compensation Committee believes the mid-year goal and performance achievement revisions were necessary and appropriate to incentivize and align the interests of senior management with Mr. Prescott’s retirement, he receivedtwo principal drivers of shareholder value and consistent with our internal business plan and our overall compensation philosophy. The Compensation Committee furthermore believed that this approach better incented senior management and aligned their interests with those of the shareholders than alternatives. For instance, the Compensation Committee could have chosen to leave the goals unchanged and make discretionary awards at the end of 2020. The Compensation could have also granted one-time awards but it did not. The Company also did not implement any salary reductions, employment furloughs or layoffs in a $25,000 cash payment intendedshort-term effort to assist with post-termination medical care costs (in lieuimprove operating income.

Without the mid-year adjustments, there would have been no payouts under the Bonus Plan based on our actual results for 2020 despite our strong recovery in the second half. Under the revised performance goals, the 2020 payouts under the Bonus Plan to senior management were 120% of any reimbursementtheir target award opportunity. The Compensation Committee believes that our strong operating results and stock performance in 2020 validate the soundness of COBRA premiums).their decision-making as reflected in the summary and discussion above under the heading "Executive Summary" and subheading "2020 Business Highlights," which include our one-year and three-year TSR of 91.5% and 140.5%, respectively.

For 2021, the Compensation Committee has once again selected the same financial metrics (i.e., revenue and operating income) and set annual targets similar to the approach it has used in previous years.

Awards to the NEOs. The Compensation Committee awarded the cash incentive awards set forth below to the NEOs for 20152020 performance. The amounts payable to the NEOs were confirmed by the Compensation Committee after review of our 2020 annual and second half results on January 26, 2021 and the payments were made to our U.S. based NEOs in accordance with our normal payroll practices on February 5, 2021 and on February 19, 2021 for Ms. Tay who is based in Singapore. These awards are also set forth below in the Summary Compensation Table on page 51 under the heading “Non-Equity"Non-Equity Incentive Plan Compensation.”Compensation." Consistent with our philosophy of linking pay to performance and the reduction in the maximum payout potential, our NEOs received cash payouts of 120% of target.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Target Incentive Award (as % of Base Salary) | | Target Incentive Award | | Company Multiplier | | Individual Multiplier | | Actual Incentive Award | | Actual Award as % of Target |

| Joseph M. Hogan | | 150% | | $ | 1,762,500 | | | 120% | | 100% | | $ | 2,115,000 | | | 120% |

| John F. Morici | | 70% | | $ | 378,000 | | | 120% | | 100% | | $ | 453,600 | | | 120% |

| Simon Beard | | 70% | | $ | 364,000 | | | 120% | | 100% | | $ | 436,800 | | | 120% |

Julie Tay (1) | | 70% | | $ | 364,000 | | | 120% | | 100% | | $ | 447,000 | | | 120% |

| Raj Pudipeddi | | 70% | | $ | 343,000 | | | 120% | | 100% | | $ | 411,600 | | | 120% |

(1) Ms. Tay's annual base salary is payable in Singapore dollars. Values in the Actual Incentive Award column are calculated after conversion of her base salary into U.S. dollars after taking into account fluctuation in the exchange rate as of each executive officer's total cash compensation increasedpay date throughout 2020. Ms. Tay's base pay was initially established at $520,000. As of December 31, 2020, as a result of fluctuations in 2015, reflecting the Company Multiplier having increased from 95%exchange rates, Ms. Tay's actual salary in 2014 to 100.6% in 2015. In addition, the Compensation Committee (with input from our CEO, other than with respect to himself) also performed a full evaluation of the individual performance component for each NEO2020 was $533,157 and determined that each NEO should receive an Individual Performance Multiplier of between 106% to 131%,her Actual Incentive Award is based on their respective contributions to the Company in their respective divisional or functional capacities.this amount.

|

| | | | | | | | | | | |

| Name | | Target Incentive Award (as % of Base Salary) | | Target Incentive Award (in 000s) | | Company Multiplier | | Individual Multiplier | Actual Incentive Award (in 000s) | | Actual Award as % of Target |

| Joseph M. Hogan | | 150% | | $831 (1) | | 100.6% | | 115% | $960 | | 115.6% |

| Thomas M. Prescott | | 100% | | $281(1) | | 100.6% | | 110% | $310 | | 110.6% |

| David L. White | | 60% | | $208 | | 100.6% | | 105% | $268.7 | | 105.6% |

| Raphael S. Pascaud | | 60% | | $238 | | 100.6% | | 130% | $311.3 | | 130.8% |

| Zelko Relic | | 60% | | $215 | | 100.6% | | 115% | $248.5 | | 115.7% |

| Roger E. George | | 60% | | $222 | | 100.6% | | 110% | $245.7 | | 110.7% |

| |

(1)

| The awards for Mr. Hogan and Mr. Prescott were pro rated based on the number of months they were employed by the Company in 2015. |

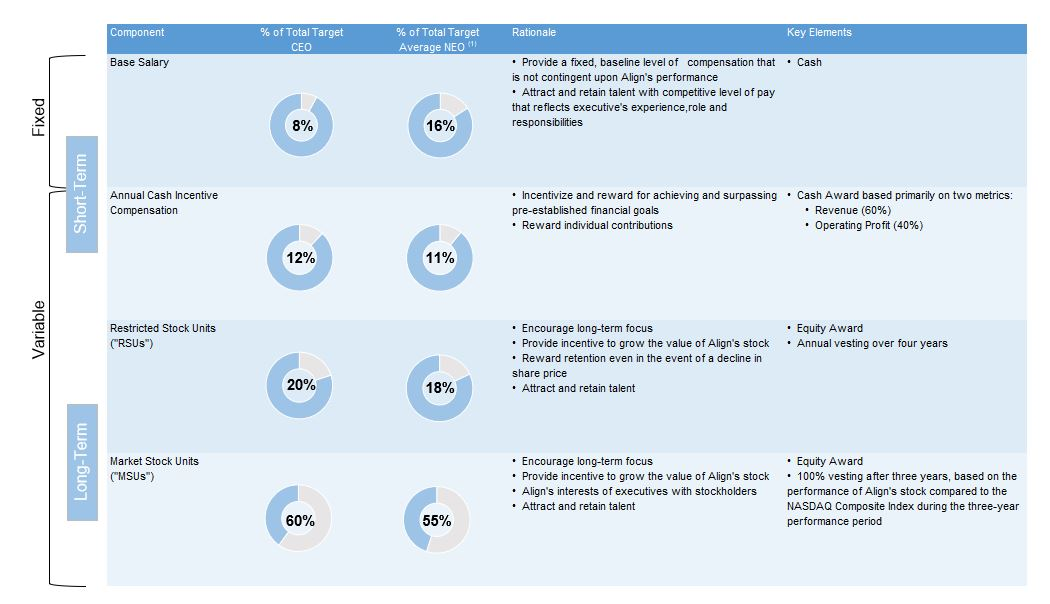

Long-Term, Equity-Based Incentive Awards

We use equity compensation to align our named executive officers’NEOs' interests with those of our stockholders and to attract and retain high-caliber executives through recognition of anticipated future performance. We determine appropriate grant amounts, if any, by reviewing competitive market data, individual performance assessments and business objectives with the Compensation Committee at least annually.

|

| | | | |

| Award Type | Rationale for 2015 portfolio |

| 2020 Portfolio |

| Why RSUs? | We believe RSUs reward retention (even in the event of a decline in Align’s share price)the price of our stock) and provide an incentive to grow the value of Align’sour stock. In addition, RSUs enable our executivessenior management to accumulate stock ownership in Align, which reinforces the Company. |

| alignment of their objectives with those of our stockholders. |

| Why MSUs? | We believe MSUs provide a vehicle that has more consistent value delivery compared to stock options which also aligns the long-term interests of our executive officerssenior management and stockholders by rewarding executivessenior management for Align’s performance measured in relation to other companies over a specified period. The actual number of shares of our common stock issuable under MSUs varies based on over-orover- or under-performance of Align’sour stock price compared to the NASDAQ Composite Index during the three-year performance period. If Align under-performs the NASDAQ Composite Index, the percentage at which the MSUs convert into shares of Alignour stock will be reduced from 100%, at a rate of twothree to one (two-percentage-point(three-percentage-point reduction in units for each percentage point of under-performance), with a minimum percentage of 0%. This means that no shares will vest if Align underperformswe underperform the NASDAQ Composite by 50approximately 33 percentage points. If Align outperformswe outperform the NASDAQ Composite Index, the percentage at which the MSUs convert to shares will be increased from 100%, at a rate of twothree to one (two-percentage-point(three-percentage-point increase in units for each percentage point of over-performance), with a maximum percentage of 150%250%. This means that if Align outperformswe outperform the NASDAQ Composite by 2550 percentage points, the maximum number of shares that will vest is 150%250% of the award amount. For example, if the NASDAQ Composite index increased by 10% over the performance period and our stock price increased by 30% over the performance period, then the number of shares issuable under the MSUs would be 140%160% of target or (130%-110%)*2=140%3=160%. |

|

| | | | |

| Award Type | Vesting Detail |

| |

| RSUs | Typically vests over four-years with 1/425% vesting annually. |

| annually |

| MSUs | Three yearThree-year performance period beginning February 2015 and ending February 2018with vesting, in full, part or not at all, at the end of year three |

Awards in 2015.2020. ConsistentIn 2020, our Compensation Committee reviewed our MSU program design and concluded that the program design was generally aligned with our ongoing efforts to align pay for performance, we continue to emphasizemarket. For awards made in 2020, the Compensation Committee set the percentage of "performance-based" equity awards granted to our executive officerssenior management at 67%. The Compensation Committee calculated the target values for equity awards to achieve this desired mix using a look back price that are tied directly to performance measured in relation to other companies over a specified period. In 2015, half ofwas based on the value of the equity-based awards30-trading day average closing price of our NEOs were designated as “performance-based.” In making these awards,common stock for the Compensation Committee again consideredperiod ending February 15, 2020. Based on this price per share, the market data, as well as the other competitive positioning factors described above. Under the employment agreement entered into with Mr. Hogan in connection with his appointment as CEO, hetotal desired number of targeted shares was granted a sign-on award consisting of 111,000 restricteddetermined, then split between time-based RSUs 33% and performance-based market stock units and 111,000 market stock units. The RSUs granted to Mr. Hogan vested 25% on December 31, 2015, with an additional 25% vesting on each December 31 thereafter for full vesting on December 31, 2018. The MSUs granted to Mr. Hogan will vest at the end of a three-year performance period which commenced on June 1, 2015.67%.

The table below sets forth the equitytarget value and number of shares awarded to the NEOs forin fiscal 2015:2020:

|

| | | | |

| Name | | RSUs | | Target MSUs (1) |

| Joseph M. Hogan | | 111,000 | | 111,000 |

| Thomas M. Prescott | | 49,000 | | 49,000 |

| David L. White | | 11,500 | | 11,500 |

| Raphael S. Pascaud | | 12,000 | | 12,000 |

| Zelko Relic | | 12,000 | | 12,000 |

| Roger E. George | | 10,700 | | 10,700 |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Target Value (RSUs) | | RSU (Shares) | | Target Value (MSUs) (1) | | Target MSUs (1) (Shares) |

| Joseph M. Hogan | | $ | 2,970,000 | | | 10,864 | | | $ | 6,030,000 | | | 22,057 | |

| John F. Morici | | $ | 660,000 | | | 2,415 | | | $ | 1,340,000 | | | 4,902 | |

| Simon Beard | | $ | 594,000 | | | 2,173 | | | $ | 1,206,000 | | | 4,412 | |

| Julie Tay | | $ | 594,000 | | | 2,173 | | | $ | 1,206,000 | | | 4,412 | |

| Raj Pudipeddi | | $ | 594,000 | | | 2,173 | | | $ | 1,206,000 | | | 4,412 | |

(1) The number of MSUs set forth in this column represents the Target Shares; however, the actual number of shares that may be earned, if any, is determined based on the formula set forth in the MSU Agreement up to a maximum of 250% of the amount of the Target Shares.

| |

(1)

| The number of MSUs set forth in this column represents the Target Shares; however, the actual number of MSUs to be earned, if any, is determined based on the formula set forth in the Market Stock Unit Agreement up to a maximum of 150% of the amount of the Target Shares. |

Severance and Change of Control Arrangements

Employment Agreements. Each NEO is eligible to receive benefits under certain conditions in accordance with their respective employment agreement. Each such agreement provides for benefits to the executive officer upon:

•a change of control; and

•termination without cause or for convenience.

In adopting the change of control provisions in these agreements, the Compensation Committee’sCommittee's primary objective was to ensure that our executivesmembers of senior management have sufficient security such that they are not biased against selling the CompanyAlign in the

event a stockholder favorable merger and acquisition transaction is presented to the Company.presented. If Align were towe pursue a change of control transaction beneficial to Alignour stockholders, the Compensation Committee believes that our executive officers’senior management's active support of the transaction through closing would be critical into ensuring the success of such a transaction.

Change of Control Only. Though the cash severance amounts payable to our executivesMessrs. Hogan and Beard and Ms. Tay in connection with a change of control are subject to a “double trigger”"double trigger" (meaning to get paid out the cash portion of their change of control arrangement, first there has to be a change of control and then the executiveindividual must be terminated without cause or for convenience within 12 monthsa specified period of time of such change of control), the Compensation Committee adopted a “single trigger”"single trigger" for all executive officersthese individuals whereby the vesting of equity awards is accelerated by one year immediately upon a change of control.

Previously, our former CEO, had

With respect to Messrs. Morici and Pudipeddi (as well as any other individual who joins Align or is promoted to a “single trigger” pursuant to which 100% of his equity would vest immediately upon a change of control. With the hiring of Mr. Hogan, however,senior management position after September 2016), the Compensation Committee determined to eliminate thiseliminated all single trigger severance and equity acceleration provisions. Rather, severance payments and equity acceleration for these members of 100% of the CEOs equity awards. Rather, Mr. Hogan’s employment agreement contains a single trigger provision equivalentsenior management are subject to the protection given to our other NEOs whereby the vesting of equity awards is accelerated only by one year immediately upon"double trigger" arrangements that require both a change of control.in control plus a qualifying termination event before any cash payments are paid or any equity acceleration occurs.

Termination within 12 Months ofFollowing a Change of Control. In the event the executive iseither Messrs. Hogan or Beard or Ms. Tay are terminated without cause or for convenience within 12 months of a change in control (“double trigger”(18 months in the case of Mr. Hogan) ('double trigger'), 100% of his or herall remaining unvested equity awards are accelerated and a cash severance payment is made. The CEO would receiveMessrs. Morici and Pudipeddi (as well as any individual who joins Align or is promoted to a senior management position after September 2016) receives a cash severance payment and 100% of her or his unvested equity awards wouldwill accelerate in the event she or he is terminated without cause or for convenience within 18 months of the change of control (“("double trigger”)trigger" for both cash payment and equity acceleration).

Termination Unrelated to a Change of Control. For termination without cause or for convenience unrelated to a change of control, the vesting of equity awards held by an NEO (except for the CEO)Ms. Tay and Mr. Beard, is immediately accelerated by one year and a cash severance payment will be made. Our CEO wouldMessrs. Hogan, Morici and Pudipeddi (as well as any individual who joins Align or is promoted to a senior management position after September 2016), receive only receive a cash severance payment (no equity acceleration). if terminated without cause or for convenience unrelated to a change of control.

Death or Disability. In the event Mr. Hogan's employment terminates as a result of his death or disability, he (or his estate) will immediately vest in 100% of all outstanding equity awards.

The cash severance benefits are intended to provide consideration for the employee’ssenior management's service to Align and the expected length of time until subsequent employment is secured. The severance provisions also assist in recruiting executivesmembers of senior management given that executivetheir roles tend to carry higher risks. The amounts that each of our current NEOs would have been entitled to if one of the termination or change of control events mentioned above occurred on December 31, 20152020 are set forth in “-PaymentsPotential Payment Upon Termination or Change of Control.”Control” below.

Other Compensation Arrangements

Welfare and Other Employee Benefits. We have establishedmaintain a tax-qualified Section 401(k) retirement plan and a Companycompany match for all U.S. employees, including our executive officers.members of senior management.

In addition, we provide health and welfare benefits to our executive officerssenior management on the same basis as all of our full-time employees in the country in which they are resident. These benefits include medical, dental and vision benefits, medical and dependent care flexible spending accounts, short-term and long-term disability insurance, accidental death, basic life insurance coverage, and our employee stock purchase plan. We design our employee benefits programs to be affordable and competitive in relation to the market, as well as compliant with applicable laws and practices. We adjust our employee benefits programs as needed based upon regular monitoring of applicable laws and practices and the competitive market.

Perquisites and Other Personal Benefits. Mr. Pascaud, who has his primary residence in the United Kingdom,Senior management is provided with a car in accordance with customary local practice as well as a housing allowance. In addition, executive officers are reimbursed for travel by a non-employee companion (eg.(e.g., spouse) to customer events and certain other Companycompany events where appropriate and it is appropriate and in our interest that the interestmember of the Company for the executive tosenior management have a companion join himher or her.him. See "Summary"Summary Compensation Table"Table" below for more information concerning these perquisites. In the future, we may provide perquisites or other personal benefits in limited circumstances, such as where we believe it is appropriate to assist an individual executive officermember of senior management in the performance of hisher or herhis duties, to make

our executive officers her or him more efficient and effective, and for recruitment, motivation, or retention purposes. All future practices with respect to perquisites or other personal benefits will be approved and subject to periodic review by the Compensation Committee.

Annual Cash Incentive Award.

In March 2016, the Compensation Committee conducted a review of our Annual Cash Incentive Award plan and adopted the following formula for 2016. The pool of available funds to pay out awards to our executive officers will be based on the extent to which the Company meets or exceeds predetermined goals under selected financial metrics. Beginning in 2016, the Compensation Committee discontinued the use of key strategic initiatives as a key metric, believing that successful implementation of key strategic initiatives helped drive revenue growth and ultimately operating income which are measured separately. Consequently, the Compensation Committee selected two financial metrics, weighted as identified below, for purposes of funding the overall pool:

Revenue - 60%

Operating Income - 40%

Considered in the aggregate for 2016, these metrics are strong indicators of our overall performance and our ability to create stockholder value. These measures were balanced among propelling growth while encouraging efficiency and are aligned with our business strategies. The Committee also determined to eliminate the individual multiplier. In determining actual bonuses to be awarded to each individual NEO, bonus amounts will be adjusted upward or downward based on an executive officer's overall performance and his or her contribution to the achievement of our performance goals.

Corporate Tax Deduction on Compensation in Excess of $1 Million a Year

The Compensation Committee is responsible for addressing issues associated with

Section 162(m) of the U.S. Internal Revenue Code. Section 162(m)Code, as amended by the Tax Cuts and Jobs Act of 2017, generally disallows a deduction for federal tax deductionpurposes to public companiesany publicly traded corporation for compensationany remuneration in excess of $1 million$1,000,000 paid in any taxable year to theits CEO, or any of theCFO and up to three other members of senior management who are among our five most highly compensated officers other than the CFO. Performance-based compensation arrangements may qualify for an exemption fromexecutive officers. Prior to amendment, qualifying “performance-based compensation” was not subject to the deduction limitlimitation if they satisfy variousspecified requirements were met. Under the Tax Cuts and Jobs Act, the performance-based exception has been repealed with respect to federal income taxes. The new rules generally apply to taxable years beginning after December 31, 2017, but do not apply to compensation provided pursuant to a written binding contract in effect on November 2, 2017 that is not modified in any material respect after that date. While we consider the deductibility of awards in determining compensation payable to senior management, we also reserve the Compensation Committee’s flexibility to provide one or more covered executive officers with the opportunity to earn compensation that is nondeductible under Section 162(m). Although Align considers the impact of this rule when developing and implementing its executive compensation programs, Align believes that factors other than tax deductibility are important in the design of executive compensation programs and that it is important to preserve flexibility in designing such programs. Accordingly, Align has not adopted a policy that all compensation must qualify as deductible under Section 162(m). While the Compensation Committee believes that stock options granted pursuantsuch compensation is appropriate to the Incentive Plan qualify as “performance-based,” other awards permitted by the terms of the Incentive Planattract and certain other amounts paid under Align’s compensation programs (such as salary) may not qualify for exemption from Section 162(m)’s deduction limitation. For 2015, approximately $1,075,421 of Mr. Hogan’s compensation was not deductible under 162(m). The 2015 compensation for all of the other NEOs was fully deductible under 162(m) as the elements of compensation that are included under Section 162(m) did not exceed $1 million for the “covered employees” described above.retain executive talent.

COMPENSATION COMMITTEE OF THE BOARD REPORT

The following is the report of the Compensation Committee of the Board with respect to the year ended December 31, 2015.2020. The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis included in this proxy statement with management. Based on the Compensation Committee’sCommittee's review and discussion with management, the Compensation Committee recommended to the Board that the Compensation Discussion and Analysis be included in this proxy statement.

|

| |

| THE COMPENSATION COMMITTEE |

| George J. Morrow, Chair |

David C. NagelAnne M. Myong |

| Andrea L. Saia |

| Greg J. Santora |

SUMMARY COMPENSATION TABLE FOR FISCAL YEAR ENDED 2015DECEMBER 31, 2020

The following Summary Compensation Table sets forth certain information regarding the compensation of (i) our President and Chief Executive Officer, (ii) our Chief Financial Officer, (iii) our former President and Chief Executive Officer, and (iv)(iii) our three next most highly compensated executive officers as ofduring fiscal 2015.2020. Information is provided for 20142019 and 20132018 for each NEO who was also a NEO during those years.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name and Principal

Position | | Year | | Salary

($) | | Bonus ($) (1) | | Stock Awards ($) (2) | | Non-Equity

Incentive Plan

Compensation

($) | | All Other

Compensation

($) | | Total

($) |

| Joseph M. Hogan, | | 2020 | | 1,171,539 | | | — | | | 11,621,453 | | | 2,115,000 | | | 614,297 | | | 15,522,289 | |

| President and Chief Executive Officer | | 2019 | | 1,125,769 | | | — | | | 13,901,609 | | | 3,220,500 | | | 21,261 | | | 18,269,139 | |

| 2018 | | 1,069,231 | | | — | | | 36,778,283 | | | 3,870,000 | | | 40,824 | | | 41,758,338 | |

| | | | | | | | | | | | | | |

| John F. Morici, | | 2020 | | 536,923 | | | — | | | 2,582,931 | | | 453,600 | | | 9,948 | | | 3,583,402 | |

| Chief Financial Officer and Senior Vice President, Global Finance | | 2019 | | 496,923 | | | — | | | 2,780,400 | | | 698,000 | | | 9,502 | | | 3,984,825 | |

| 2018 | | 457,539 | | | — | | | 2,170,410 | | | 718,000 | | | 9,234 | | | 3,355,183 | |

| | | | | | | | | | | | | | |

Simon Beard, Senior Vice President, Managing Director, Americas | | 2020 | | 517,692 | | | — | | | 2,324,581 | | | 436,800 | | | 76,334 | | | 3,355,407 | |

| Julie Tay, | | 2020 | | 533,157 | | | — | | | 2,324,581 | | | 447,000 | | | 49,594 | | | 3,354,332 | |

| Senior Vice President and Managing Director, Asia Pacific | | 2019 | | 501,891 | | | — | | | 2,471,513 | | | 661,967 | | | 43,172 | | | 3,678,543 | |

| | | | | | | | | | | | | | |

| Raj Pudipeddi, | | 2020 | | 488,077 | | | — | | | 2,324,581 | | | 411,600 | | | 10,292 | | | 3,234,550 | |

| Senior Vice President, and Chief Product, Innovation & Marketing Officer | | 2019 | | 402,404 | | | 10,000 | | | 2,351,716 | | | 618,000 | | | 98,648 | | | 3,480,768 | |

(1)Amount reflects a one-time signing bonus for Mr. Pudipeddi.

(2)The amounts shown in this column reflect the aggregate grant date fair value computed in accordance with FASB ASC Topic 718. Assumptions used in the calculations of these amounts are included in Note 1 - Summary of Significant Accounting Policies, Stock-Based Compensation and Note 12 - Stockholders' Equity (collectively, "Notes 1 and 12") to our audited financial statements for the year ended December 31, 2020 included in our Annual Report on Form 10-K filed with the SEC on February 26, 2021. This same method was used for the years ended December 31, 2019 and 2018.

The grant date fair value of the MSU awards reflected in the Stock Awards column and the tables below is computed based on the probable outcome of the performance conditions as of the grant date. This amount is consistent with the estimate of aggregate compensation cost we expect to recognize over the three-year performance period of the award determined as of the grant date under FASB ASC Topic 718. Refer to Notes 1 and 12 for the assumptions used to value the RSU and MSU awards. The amounts shown in the Stock Awards Column and the tables below exclude the impact of estimated forfeitures and there can be no assurance that the grant date fair value amounts will ever be realized.

| | | | | | | | | | | | | | |

| Name | | Fiscal Year 2020 RSUs | | Fiscal Year 2020 MSUs |

| Joe Hogan | | $ | 2,960,331 | | | $ | 8,661,122 | |

| John Morici | | $ | 658,063 | | | $ | 1,924,868 | |

| Simon Beard | | $ | 592,121 | | | $ | 1,732,460 | |

| Julie Tay | | $ | 592,121 | | | $ | 1,732,460 | |

| Raj Pudipeddi | | $ | 592,121 | | | $ | 1,732,460 | |

|

| | | | | | | | | | | | | | | | | | | | | | | |

Name and Principal Position | | Year | | Salary ($) | | Bonus ($) (2) | | Stock Awards ($) (3) | | Option Awards ($)(3) | | Non-Equity Incentive Plan Compensation ($) | | All Other Compensation ($) | | Total ($) |

Joseph Hogan, President & Chief Executive Officer (1) | | 2015 | | 548,077 |

| | 1,500,000 |

| | 14,330,100 |

| | | | 960,000 |

| | 44,822 |

| | 17,382,999 |

|

| | | | | | | | | | | | | | | | | |

Thomas M. Prescott,

Former President & Chief Executive Officer (1) | | 2015 | | 705,000 |

| | 25,000 |

| | 5,564,440 |

| | — |

| | 310,000 |

| | 86,405 |

| | 6,690,845 |

|

| | 2014 | | 645,962 |

| | — |

| | 7,948,800 |

| | — |

| | 585,000 |

| | 10,464 |

| | 9,190,226 |

|

| | 2013 | | 615,000 |

| | — |

| | 4,406,900 |

| | — |

| | 900,000 |

| | 11,355 |

| | 5,933,255 |

|

| | | | | | | | | | | | | | | | | |

David L. White Chief Financial Officer | | 2015 | | 438,346 |

| | — |

| | 1,305,940 |

| | — |

| | 268,700 |

| | 9,090 |

| | 2,022,076 |

|

| | 2014 | | 406,192 |

| | — |

| | 1,645,480 |

| | — |

| | 241,700 |

| | 9,268 |

| | 2,302,640 |

|

| | 2013 | | 153,846 |

| | — |

| | 3,239,864 |

| | — |

| | 159,656 |

| | 4,978 |

| | 3,558,344 |

|

| | | | | | | | | | | | | | | | | |

| Raphael S. Pascaud | | 2015 | | 374,317 |

| | — |

| | 1,362,720 |

| | — |

| | 311,300 |

| | 2,298 |

| | 2,050,635 |

|

| Chief Marketing Portfolio and Business Development Officer | | 2014 | | 334,007 |

| | 125,453 |

| | 2,371,593 |

| |

| | 228,600 |

| | 43,278 |

| | 3,102,931 |

|

| | 2013 | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| | | | | | | | | | | | | | | | | |

| Zelko Relic | | 2015 | | 366,231 |

| | — |

| | 1,362,720 |

| | — |

| | 248,500 |

| | 9,090 |

| | 1,986,541 |

|

| Vice President, Research and Development | | | | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Roger E. George | | 2015 | | 382,368 |

| | — |

| | 1,215,092 |

| | — |

| | 245,700 |

| | 9,090 |

| | 1,852,250 |

|

| Vice President, Legal & Corporate Affairs | | 2014 | | 351,699 |

| | — |

| | 2,324,904 |

| | — |

| | 212,000 |

| | 8,667 |

| | 2,897,270 |

|

| | 2013 | | 335,183 |

| | — |

| | 1,724,193 |

| | — |

| | 372,790 |

| | 8,367 |

| | 2,440,533 |

|

| | | | | | | | |

(1)

Name | Mr. Prescott retired as CEO and Mr. | Value of Fiscal Year 2020 MSUs Assuming Maximum Performance |

Joe Hogan was appointed as CEO in June 2015. As a result, Mr. Hogan's salary and non-equity incentive plan compensation are pro rated based on the number of months he was employed by Align in the capacity of CEO. Pursuant to Mr. Prescott's Transition Agreement, he received seven month's salary continuation through December 31, 2015 for an aggregate of $393,750. His non-equity incentive plan compensation, however, was prorated based on the number of months (5/12) that he acted as our President and CEO. |

| $ | 15,025,644 | |

(2)

John Morici | Amounts reflect (i) a one-time signing bonus for Mr. Hogan, (ii) a one-time bonus of $25,000 intended to assist Mr. Prescott with post-termination medical care cost (in lieu of any reimbursement of COBRA premiums); and (iii) a special retention bonus paid to Mr. Pascaud in connection with our previous VP, International, Richard Twomey's departure. |

| $ | 3,339,365 | |

(3)

Simon Beard | The amounts shown in this column reflect the aggregate grant date fair value computed in accordance with FASB ASC Topic 718. Assumptions used in the calculations of these amounts are included in Note 9 to our audited financial statements for the year ended December 31, 2015 included in the Company’s Annual Report on Form 10-K filed with the SEC on February 25, 2016. This same method was used for years ended December 31, 2014 and 2013. There can be no assurance that the grant date fair value amounts will ever be realized. | $ | 3,005,565 | |

| Julie Tay | | $ | 3,005,565 | |

| Raj Pudipeddi | | $ | 3,005,565 | |

Total Compensation. TotalMr. Hogan's decrease in total compensation as reported in the Summary Compensation table2020 compared to 2019 was primarily due to a lower grant date fair value of his equity awards and decreased significantly from 2014 to 2015 for listed officers (other than our new CEO),cash bonus largely due to the one-time, special recognitionimpact of the COVID-19 pandemic in the second quarter of 2020, partially offset by an increase in compensation related to his required relocation to Arizona in conjunction with relocation of our corporate headquarters to Tempe, Arizona. Total compensation for each of Messrs. Morici and Pudipeddi and Ms. Tay in 2020 primarily decreased as a result of lower grant date fair values of their equity awards grantedand decreased cash bonuses largely due to the impact of the COVID-19 pandemic in 2014 to reward contributions towards our record-setting 2013 results and strengthen retention. Total cash compensation, increased morethe second quarter of 2020.

modestly which is consistent with our philosophy of linking pay to performance and reflects the Company Multiplier described above having increased in 2015 to 100.6% from 95% in 2014. For additional information regarding the amounts included in the Summary Compensation Table, see “—Compensation"Compensation Discussion and Analysis”Analysis" above.

Stock Awards.Stock awards include time-based RSUs that typically vest over a four yearfour-year vesting period, as well as MSUs which are earned based on a comparison of Align’sour stock price performance to the NASDAQ Composite index over a 3-yearthree-year performance period.

Option Awards. We did not grant any options inperiod and vest at the past three years.end of the third year.

Non-Equity Incentive Plan Compensation. The amounts shown in this column represent employee annual incentive award payments and are reported for the year in which they were earned, though they were paid in the following year. The material terms of the performance payment plan are described under "“Compensation Discussion and Analysis –Annual– Annual Cash Incentive (Bonus) Compensation.”Compensation" above.

All Other Compensation.The amounts shown in this column and detailed in the table below represent the aggregate dollar amount for each NEO for a Company 401(k) matching program, life insurance and accidental death and dismemberment premiums, our 401(k) matching program (retirement plan in the case of Ms. Tay), as well as employee discount programs for our products which are available to all employees, including our NEOs. TheNEOs, reimbursements for automobiles and medical expenses and foreign assignment and relocation expenses.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Dollar

Value of

Life

Insurance

Premiums | | Matching

contributions

under our

401(k) Plan (or retirement plan) | | Employee Discount Program | | Automobile Reimbursement | | Medical Expense Reimbursement Plan |

| Mr. Hogan | | $ | 1,296 | | | $ | 8,550 | | | $ | — | | | $ | — | | | $ | 1,333 | |

| Mr. Morici | | $ | 1,190 | | | $ | 8,550 | | | $ | 208 | | | $ | — | | | $ | — | |

| Mr. Beard | | $ | 1,146 | | | $ | 8,550 | | | $ | — | | | $ | — | | | $ | — | |

| Ms. Tay | | $ | — | | | $ | 13,116 | | | $ | — | | | $ | 29,953 | | | $ | 6,525 | |

| Mr. Pudipeddi | | $ | 1,080 | | | $ | 8,550 | | | $ | — | | | $ | — | | | $ | 662 | |

Foreign Assignment and Relocation Expenses. In addition to the amounts set forth in the table above, for Mr. Beard, who was asked to relocate to the United States in September 2019 on a three year employment assignment in connection with a change in his role and responsibilities to Senior Vice President and Managing Director, Americas from a similar role in EMEA and whose family remains residing in the United Kingdom, the amounts in the All Other Compensation column also include expenses related to Mr. Beard’s expatriate assignment, including (a) commuting travel expense, cost of living allowances, housing allowancesallowance, car allowance, goods and airfareservices and tax prep fees of approximately $195,712 and (b) tax equalization payments pursuant to the Company’s tax equalization policy for travel companion, relocation as well as accrued vacation upon retirementemployees on expatriate assignment. The amount shown includes the net total of tax equalization payments for Mr. Beard received by the Company, or that became fixed and determinable, during 2020 of approximately $129,074. This net amount is attributable to aggregated U.S. tax payments made by the Company of $1,284,903, UK tax payments of $924,120 offset by tax withholdings from Mr. Beard of $2,338,097. Due to time lags in tax determinations, differences in taxable periods between jurisdictions, the availability of foreign tax credits or refunds and the potential receipt by the Company of credits or refunds in subsequent years, there may be significant differences in tax equalization payments from year to year.

Also in addition to the amounts in the table above, for Mr. Hogan, who was required to move to Arizona in connection with the move of our CEO.corporate headquarters to Tempe, Arizona in January 2021, the amounts in the All Other Compensation

column also include employment relocation expenses of $603,118. The foregoing amount includes $284,615 for costs incurred by Mr. Hogan in relocating his residence with the remainder provided to him to make his relocation expenses tax neutral.

|

| | | | | | | | | | | | | | | | | | | | |

| Name | | Dollar Value of Life Insurance Premiums | | Matching contributions under Align’s 401(k) Plan | | | Airfare for travel companion | | Accrued Vacation Payout | Relocation |

| Mr. Hogan | | $ | 1,078 |

| | $ | 7,125 |

| | | $ | 26,562 |

| | — |

| $ | 10,057 |

|

| Mr. Prescott | | $ | 570 |

| | $ | 7,950 |

| | | — |

| | $ | 77,884 |

| — |

|

| Mr. White | | $ | 1,140 |

| | $ | 7,950 |

| | | — |

| | — |

| — |

|

| Mr. Pascaud | | $ | 2,298 |

| | — |

| | | — |

| | — |

| — |

|

| Mr. Relic | | $ | 1,140 |

| | $ | 7,950 |

| | | — |

| | — |

| — |

|

| Mr. George | | $ | 1,140 |

| | $ | 7,950 |

| | | — |

| | — |

| — |

|

GRANTS OF PLAN-BASED AWARDS FOR FISCAL YEAR ENDED 20152020

The following table shows all plan-based awards granted to the NEOs during 2015,2020 including:

•cash amounts that could have been received in 20152020 by our NEOs under the terms of our performance-based cash incentive plan (CIP); and

•time-vested RSUs and performance-based MSUs awards granted by the Compensation Committee to our NEOs in 20152020 reflected on an individual grant basis.

20152020 Grants of Plan-Based Awards

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | Type of Award | | Grant Date | | Approval Date | | Estimated Future Payouts Under Non-Equity Incentive Awards | | Non-equity Incentive | | Estimated Future Payouts Under Equity Incentive Awards | | All Other Stock Awards: Number of Shares of Stock or Units (#) | | Grant Date Fair value of Options and Awards ($) |

| Name | Target ($) | | Maximum ($) | | Target (#) | | Maximum (#) | |

| Joseph M. Hogan | CIP | | | | | | $ | 831,300 |

| | 1,995,120 |

| | | | | | | | |

| | RSU | | 6/1/2015 | | 3/21/2015 | | | | | | | | | | 111,000 |

| | $ | 6,853,140 |

|

| | MSU | | 6/1/2015 | | 3/21/2015 | | | | | | 111,000 |

| | 166,500 |

| | | | $ | 7,476,960 |

|

| Thomas M. Prescott | CIP | | | | | | $ | 281,300 |

| | 675,120 |

| | | | | | | | |

| RSU | | 2/20/2015 | | 2/2/2015 | | | | | | | | | | 49,000 |

| | $ | 2,783,690 |

|

| | | | | | | | | | | | | | | | | |

| MSU | | 2/20/2015 | | 2/2/2015 | | | | | | 49,000 |

| | 73,500 |

| | | | $ | 2,780,750 |

|

| David L. White | CIP | | | | | | $ | 254,000 |

| | 609,600 |

| | | | | | | | |

| RSU | | 2/20/2015 | | 2/2/2015 | | | | | | | | | | 11,500 |

| | $ | 653,315 |

|

| | | | | | | | | | | | | | | | | |

| MSU | | 2/20/2015 | | 2/2/2015 | | | | | | 11,500 |

| | 17,250 |

| | | | $ | 652,625 |

|

| Raphael S. Pascaud | CIP | | | | | | $ | 238,000 |

| | 571,200 |

| | | | | | | | |

| RSU | | 2/20/2015 | | 2/2/2015 | | | | | | | | | | 12,000 |

| | $ | 681,720 |

|

| | | | | | | | | | | | | | | | | |

| MSU | | 2/20/2015 | | 2/2/2015 | | | | | | 12,000 |

| | 18,000 |

| | | | $ | 681,000 |

|

| Zelco Relic | CIP | | | | | | $ | 215,000 |

| | 516,000 |

| | | | | | | | |

| | | | | | | | | | | | | | | | | |

| RSU | | 2/20/2015 | | 2/2/2015 | | | | | | | | | | 12,000 |

| | $ | 681,720 |

|

| | | | | | | | | | | | | | | | | |

| MSU | | 2/20/2015 | | 2/2/2015 | | | | | | 12,000 |

| | 18,000 |

| | | | $ | 681,000 |

|

| Roger E. George | CIP | | | | | | $ | 222,000 |

| | 532,800 |

| | | | | | | | |

| RSU | | 2/20/2015 | | 2/2/2015 | | | | | | | | | | 10,700 |

| | $ | 607,867 |

|

| | | | | | | | | | | | | | | | | |

| MSU | | 2/20/2015 | | 2/2/2015 | | | | | | 10,700 |

| | 16,050 |

| | | | $ | 607,225 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Type

of

Award | | Grant

Date | | Approval

Date | | Estimated

Future

Payouts

Under

Non-Equity

Incentive Plan

Awards | | Non-equity Incentive | | Estimated Future

Payouts Under

Equity Incentive Plan

Awards | | All

Other

Stock

Awards:

Number

of

Shares

of Stock

or Units

(#) | | Grant Date

Fair value

of Awards ($) |

| Name | | Target

($) | | Maximum ($) | | Target

(#) | | Maximum

(#) | |

| Joseph M. Hogan | | CIP | | | | | | 1,762,500 | | | 4,230,000 | | | | | | | | | |

| RSU | | 2/20/2020 | | 1/28/2020 | | | | | | | | | | 10,864 | | | 2,960,331 | |

| MSU | | 2/20/2020 | | 1/28/2020 | | | | | | 22,057 | | | 55,142 | | | | | 8,661,122 | |

| John F. Morici | | CIP | | | | | | 378,000 | | | 907,200 | | | | | | | | | |

| RSU | | 2/20/2020 | | 1/28/2020 | | | | | | | | | | 2,415 | | | 658,063 | |

| MSU | | 2/20/2020 | | 1/28/2020 | | | | | | 4,902 | | | 12,255 | | | | | 1,924,868 | |

| Simon Beard | | CIP | | | | | | 364,000 | | | 873,600 | | | | | | | | | |

| RSU | | 2/20/2020 | | 1/28/2020 | | | | | | | | | | 2,173 | | | 592,121 | |

| MSU | | 2/20/2020 | | 1/28/2020 | | | | | | 4,412 | | | 11,030 | | | | | 1,732,460 | |

| Julie Tay | | CIP | | | | | | 364,000 | | | 873,600 | | | | | | | | | |

| RSU | | 2/20/2020 | | 1/28/2020 | | | | | | | | | | 2,173 | | | 592,121 | |

| MSU | | 2/20/2020 | | 1/28/2020 | | | | | | 4,412 | | | 11,030 | | | | | 1,732,460 | |

| Raj Pudipeddi | | CIP | | | | | | 343,000 | | | 823,200 | | | | | | | | | |

| RSU | | 2/20/2020 | | 1/28/2020 | | | | | | | | | | 2,173 | | | 592,121 | |

| | MSU | | 2/20/2020 | | 1/28/2020 | | | | | | 4,412 | | | 11,030 | | | | | 1,732,460 | |

Approval Date.For each NEO equity grant, except for Mr. Hogan, the Compensation Committee met on February 2, 2015January 28, 2020 to finalize the grant of annual equity awards. Upon approval of the RSU and MSU awards, for each NEO, the Compensation Committee determined that the actual date of grant would be February 20, 2015.2020. This grant date was chosen in order to allow sufficient time for the CEO to notify each NEO and other members of the management team of the grant. In connection with Mr. Hogan joining Align as President and CEO, the Compensation Committee approved his new hire grant on March 21, 2015, with the actual date of grant of June 1, 2015.

Estimated Future Payouts under Non-Equity Incentive Plan Awards.The amounts shown under this column represent the possible dollar payouts the NEOs could have earned for 20152020 at target.target prior to the Compensation Committee's mid-year reassessment and revision of the Bonus Plan for senior management. For 2015,2020, the target cash incentive award for each NEO (other than the CEO and former CEO) was 60%70% of his base salary. For our CEO and former CEO, the target cash incentive award was 150% and 100% of his base salary, respectively, and was pro-rated based on the number of months each individual was acting in the capacity of our CEO.salary.

For a description of the performance objectives applicable to the receipt of these payments, see “"Compensation Discussion and Analysis –Annual Cash Incentive Awards.”" The actual amount paid to each NEO for 20152020 performance is set forth in the Summary Compensation Table above in the column "“Non-Equity Incentive Plan Compensation.”"

•Threshold. There is no threshold performance level. Rather, the Company'sAlign's financial performance below a specific target automatically reduces only the payout related to that specific goal, not the other goals, because we want executivessenior management to have the same incentive to achieve strategic priorities as well as their individual performance goals even if our financial performance tracks below the target during the course of the year.

•Target. The target amounts assume a corporate performance percentage of 100% and that the NEO received 100% of her or his target.

•Maximum. Although each financial objective isThe maximum amount a NEO can receive was initially capped at 200%240% of their target award opportunity when the Compensation Committee established goals and objectives at the beginning of 2020. That amount was later

reduced to 120% of their target award opportunity when the Compensation Committee reassessed our annual cash incentive plan mid-year. Please see the discussion above under "Impact of the COVID-19 Pandemic on the 2020 Annual Cash Incentive Plan" for fundinga further discussion of the total pool available for distribution, there is no maximum amount that an NEO could receive.mid-year adjustments to our 2020 Bonus Plan performance goals.

Estimated Future Payouts under Equity Incentive Plan Awards.Awards:

•Focal Awards Granted February 2020. The amounts shown under this columnfor MSU awards granted in February 2020 represent potential share payouts with respect to MSUs. Each MSU vests over a three-year performance period, with 100% vesting inas of February 2018.2023. The actual number of MSUsshares eligible to vest will be determined based on a comparison of Align’sour stock price performance relative to the performance of the NASDAQ Composite index over the three-year performance period, up to a maximum of 150%250% of the number of target shares. If Align under-performswe under-perform the NASDAQ Composite index, the percentage at which the MSUs convert into shares of Alignour stock will be reduced from 100%, at a rate of twothree to one (two-percentage-point(three-percentage-point reduction in units for each percentage point of under-performance), with a minimum percentage of 0%. This means that no shares will vest if Align underperformswe underperform the NASDAQ Composite index by 50%approximately 33%. If Align outperformswe outperform the NASDAQ Composite index, the percentage at which the MSUs convert to shares will be increased from 100%, at a rate of twothree to one (two-percentage-point(three-percentage-point increase in units for each percentage point of over-performance), with a maximum percentage of 150%250%. This means that if Align outperforms the NASDAQ Composite index by 25%approximately 50%, the maximum number of shares that will vest is 150%250% of the award amount.

•Stock Awards. Stock awards represent grants of RSUs under our 2005 Incentive Plan. Since RSUs are taxable to each NEO when they vest, the number of shares we issue to each named executive officer will be net of applicable withholding taxes which we will be paid by Alignpay on behalf of each NEO. The RSUs will result in payment to the NEO only if the vesting criteria are met.is met and the NEO then sells the stock that has vested. Each RSU granted to our NEOs vestvests over a four-year period with 25% of the shares subject to the RSU vesting each anniversary of the date of grant, with full vesting in four years.

Grant Date Fair Value. The amounts shown in this column reflect the aggregate grant date fair value computed in accordance with FASB ASC Topic 718 of awards of RSUs and MSUs.MSUs, excluding the effect of estimated forfeitures. Assumptions used in the calculations of theseMSUs amounts are included in Note 9Notes 1 and 12 to our audited financial statements for the year ended December 31, 20152020 included in the Company’sour Annual Report on Form 10-K filed with the SEC on February 26, 2016.2021. There can be no assurance that the grant date fair value amounts will ever be realized. The RSUs are time based awards and are not subject to performance conditions. Amounts for MSUs represent the estimate of the aggregate compensation cost to be recognized over the three-year performance period determined as of the grant date under FASB ASC Topic 718, excludingdate. For MSU awards granted in February 2020, the effect of estimated forfeitures. The actual number of shares that arewill be paid out will depend on Align’sour stock price performance relative to the performance of the NASDAQ Composite index over the three-year performance period, up to a maximum of 150%250% of the number of target shares.

Timing of Equity Grants. The Compensation Committee, in consultation with management, our independent auditors and legal counsel, has adopted the following practices on equity compensation awards:

Align does•We do not plan to time, nor has ithave we timed, the release of material non-public information for the purpose of affecting the exercise price of itsany stock options;options should we decide to grant stock options again in the future;

| |

• | consistent with the policy described in the bullet point above, all awards of equity compensation for new employees (other than new executive officers described in the next bullet point) are made on the first day of the month for those employees who started during the period between the 16th day of the month that is two months prior to the grant date and the 15th day of the month prior to the month of the grant date. For example, May 1, 2016 grants will cover new hires starting between March 16, 2016 and April 15, 2016; and

|

annual•Consistent with the policy described in the bullet point above, all awards of equity compensation for new employees (other than new members of senior management) are made on the first day of the month for those employees who started during the period between the 16th day of the month that is two months prior to the grant date and the 15th day of the month prior to the month of the grant date. For example, May 1, 2020 grants will cover new hires starting between March 16, 2020 and April 15, 2020; and

•Annual incentive grants are made on or about the same day for all employees (including executive officers)members of senior management); in each of 2015, 20142020, 2019, and 20132018 such date was February 20. The Compensation Committee sets the actual grant date approximately one week following approval of the size of each grant in order to provide Align managersmanagement with adequate time to inform each employee individually of their grant.

OUTSTANDING EQUITY AWARDS AT FISCAL 20152020 YEAR END

The following table sets forth information regarding outstanding equity awards as of December 31, 20152020 for each NEO. All vesting is contingent upon their continued employment with Align. Market values and payout values in this table are calculated based on the closing market price of our common stock of $534.38 per share, as reported on the NASDAQ Global Market on December 31, 2015,2020, which was $65.85 per share.the last trading day of the year.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Stock Awards |

| Number of Shares or Units of Stock That Have Not Vested

(#) | | F

o

o

t

n

o

t

e | | Market Value of Shares or Units of Stock That Have Not

Vested

($) | | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights that have Not Vested

(#) | | F

o

o

t

n

o

t

e | | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested

($) |

| Joseph M. Hogan | | 6,250 | | | (1) | | 3,339,875 | | | | | | | |

| | 4,800 | | | (2) | | 2,565,024 | | | | | | | |

| | 10,046 | | | (3) | | 5,368,381 | | | | | | | |

| | 10,864 | | | (4) | | 5,805,504 | | | | | | | |

| | | | | | | | 19,200 | | | (5) | | 10,260,096 | |

| | | | | | | | 43,100 | | | (6) | | 23,031,778 | |

| | | | | | | | 26,789 | | | (7) | | 14,315,506 | |

| | | | | | | | 22,057 | | | (8) | | 11,786,820 | |

| John F. Morici | | 1,750 | | | (1) | | 935,165 | | | | | | | |

| | 1,573 | | | (9) | | 840,580 | | | | | | | |

| | 1,150 | | | (2) | | 614,537 | | | | | | | |

| | 2,009 | | | (3) | | 1,073,569 | | | | | | | |

| | 2,415 | | | (4) | | 1,290,528 | | | | | | | |

| | | | | | | | 4,500 | | | (5) | | 2,404,710 | |

| | | | | | | | 5,358 | | | (7) | | 2,863,208 | |

| | | | | | | | 4,902 | | | (8) | | 2,619,531 | |

| Simon Beard | | 1,500 | | | (1) | | 801,570 | | | | | | | |

| | 900 | | | (2) | | 480,942 | | | | | | | |

| | 1,674 | | | (3) | | 894,552 | | | | | | | |

| | 2,173 | | | (4) | | 1,161,208 | | | | | | | |

| | | | | | | | 3,700 | | | (5) | | 1,977,206 | |

| | | | | | | | 4,465 | | | (7) | | 2,386,007 | |

| | | | | | | | 4,412 | | | (8) | | 2,357,685 | |

| Julie Tay | | 1,550 | | | (1) | | 828,289 | | | | | | | |

| | 900 | | | (2) | | 480,942 | | | | | | | |

| | 1,785 | | | (3) | | 953,868 | | | | | | | |

| | 2,173 | | | (4) | | 1,161,208 | | | | | | | |

| | | | | | | | 3,700 | | | (5) | | 1,977,206 | |